Saudi Arabia Seafood Market Size and Share Analysis: Growth Trends and Forecast Report 2025-2033

Market Overview

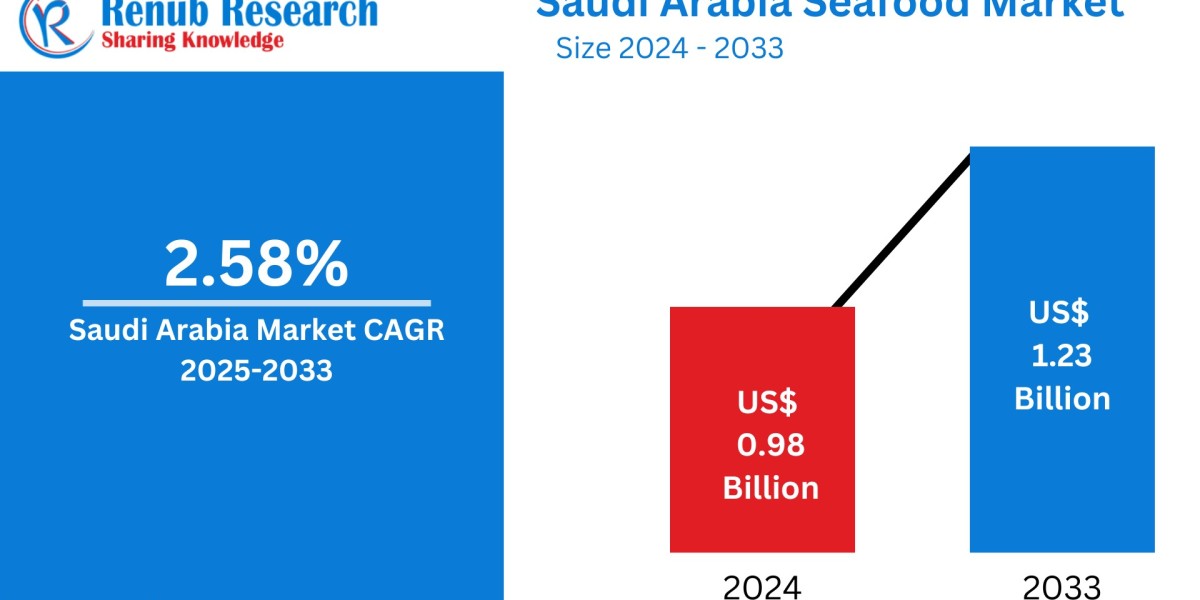

The Saudi Arabia seafood market is experiencing significant growth, driven by changing consumer preferences, government initiatives, and technological advancements in aquaculture. From a market size of USD 0.98 billion in 2024, it is expected to reach USD 1.23 billion by 2033, growing at a compound annual growth rate (CAGR) of 2.58% from 2025 to 2033. With the government’s commitment to Vision 2030, expanding infrastructure, and increasing domestic production, Saudi Arabia is becoming a key player in both the regional and global seafood markets.

Table of Contents

- Introduction

- Saudi Arabia Seafood Market Overview

- Key Market Trends

- Market Drivers & Challenges

- Government Support and Industry Innovations

- Market Segmentation Analysis

- By Type

- By Form

- By Distribution Channel

- By Region

- Growth Drivers for the Saudi Arabian Seafood Market

- Government Initiatives and Vision 2030

- Technological Developments in Aquaculture

- Health and Nutrition Awareness

- Challenges in the Saudi Arabian Seafood Market

- Overfishing and Sustainability Concerns

- Dependency on Imports

- Regional Market Analysis

- Eastern Saudi Arabia

- Western Saudi Arabia

- Company Analysis

- Key Players Overview

- Recent Developments

- Revenue Insights

- Conclusion

- Market Outlook

Saudi Arabia Seafood Market Trends & Summary

Saudi Arabia's seafood market has gained momentum due to several factors. Consumer health consciousness has been a key driver, with more individuals turning to seafood as a sustainable, protein-rich alternative to traditional meats. Additionally, advancements in aquaculture technology have enhanced local production efficiency. Government programs under Vision 2030 are significantly shaping the market, focusing on sustainable practices and boosting local seafood production. By 2030, the government aims to produce 600,000 tons of seafood, making Saudi Arabia a central player in the global seafood industry.

Market Segmentation:

- By Type:

- Fish

- Shrimp

- Crab

- Lobster

- Others

- By Form:

- Canned

- Fresh / Chilled

- Frozen

- Processed

- By Distribution Channel:

- Supermarket/Hypermarket

- Departmental Stores

- Specialized Stores

- Institution Sales

- Food Service

- Online

- By Region:

- Western Region

- Northern & Central Region

- Eastern Region

- Southern Region

Saudi Arabia Seafood Industry Overview

The seafood sector in Saudi Arabia has gained attention due to its role in diversifying the economy under the Vision 2030 plan. Traditional seafood consumption is influenced by rich marine resources in the Red Sea and Arabian Gulf. Furthermore, with a focus on sustainable practices, the country is advancing local production through significant investments in aquaculture. Saudi Arabia’s seafood exports are increasing, thanks to infrastructure improvements and technological innovations that support both local and international demand.

Growth Drivers for the Saudi Arabia Seafood Market

Government Initiatives and Vision 2030

The Saudi Arabian government’s Vision 2030 emphasizes reducing reliance on oil and enhancing food security, positioning aquaculture as a critical industry. Programs like the National Fisheries Development Program (NFDP), with a focus on infrastructure and technology investment, have been crucial in driving the sector forward. The government has set a target of producing 600,000 tons of seafood by 2030.

Technological Developments in Aquaculture

Innovations such as recirculating aquaculture systems (RAS), automated feeding systems, and genetic enhancement of species have improved production efficiency and sustainability. These advancements have enhanced both local fish farming and wild seafood sourcing, ensuring sustainable growth. Technologies have also helped to extend the shelf life of products through enhanced cold chain logistics, enabling better product quality and market reach.

Health and Nutrition Awareness

Health-conscious consumers are increasingly opting for seafood due to its nutritional benefits, including high protein content and omega-3 fatty acids. Public health campaigns, such as those by the Saudi Food and Drug Authority (SFDA), have further accelerated this shift toward healthier eating habits, boosting the demand for seafood.

Challenges in the Saudi Arabia Seafood Market

Overfishing and Sustainability Concerns

While the industry has seen positive growth, overfishing remains a major concern, impacting the long-term sustainability of marine resources. Unsustainable fishing practices, along with illegal fishing activities, pose a threat to the balance of marine ecosystems. Strict enforcement of sustainability laws and eco-friendly practices is necessary to address these challenges.

Dependency on Imports

Although the Saudi Arabian seafood industry has increased local production, it still heavily depends on imports to meet growing domestic demand. Geopolitical risks, supply chain disruptions, and fluctuating global prices pose a challenge to the sustainability of this model. The government is investing in aquaculture to address this issue and reduce reliance on imports.

Saudi Arabia Seafood Market Overview by Regions

Eastern Saudi Arabia Seafood Market

The Eastern region of Saudi Arabia, with its expansive coastline along the Arabian Gulf, plays a central role in seafood production. Rich in marine biodiversity, this region caters to both local consumption and export markets. However, overfishing remains a significant concern.

Western Saudi Arabia Seafood Market

Along the Red Sea, the Western region has a diverse range of seafood, from fish to shellfish. Cities like Jeddah and Mecca are key markets, benefiting from both local demand and tourism. This region faces similar sustainability issues as the Eastern region but continues to grow through aquaculture innovation.

Key Players in the Saudi Arabia Seafood Market

Several major companies dominate the Saudi seafood market, each contributing to the expansion and sustainability of the sector.

- Almunajem Foods – A leading supplier of seafood, known for its wide range of frozen seafood products.

- Arab Fisheries Co. – A key player in both domestic and export seafood production.

- IZAFCO Fish Packing Company – Specializes in the processing and packaging of seafood products.

- National Aquaculture Group – A prominent company focusing on sustainable aquaculture practices.

- Saudi Fisheries Company – Known for its contribution to both wild-caught and farmed seafood.

- Shell Fisheries Company W.L.L. – A significant player in the shellfish sector.

- Tabuk Fisheries Co. – Involved in aquaculture and seafood processing.

- The Savola Group – A major food conglomerate with a strong presence in the seafood market.

Conclusion: Market Outlook

The Saudi Arabian seafood market is poised for steady growth, supported by government initiatives, technological advancements in aquaculture, and increasing consumer demand for healthier food options. However, challenges such as overfishing and reliance on imports must be addressed for the sector to reach its full potential. With ongoing investments and a focus on sustainability, Saudi Arabia is set to establish itself as a global leader in seafood production by 2033.