North America Smart Home Security Camera Market Size and Share Analysis – Growth Trends and Forecast Report 2025–2033

Market Overview

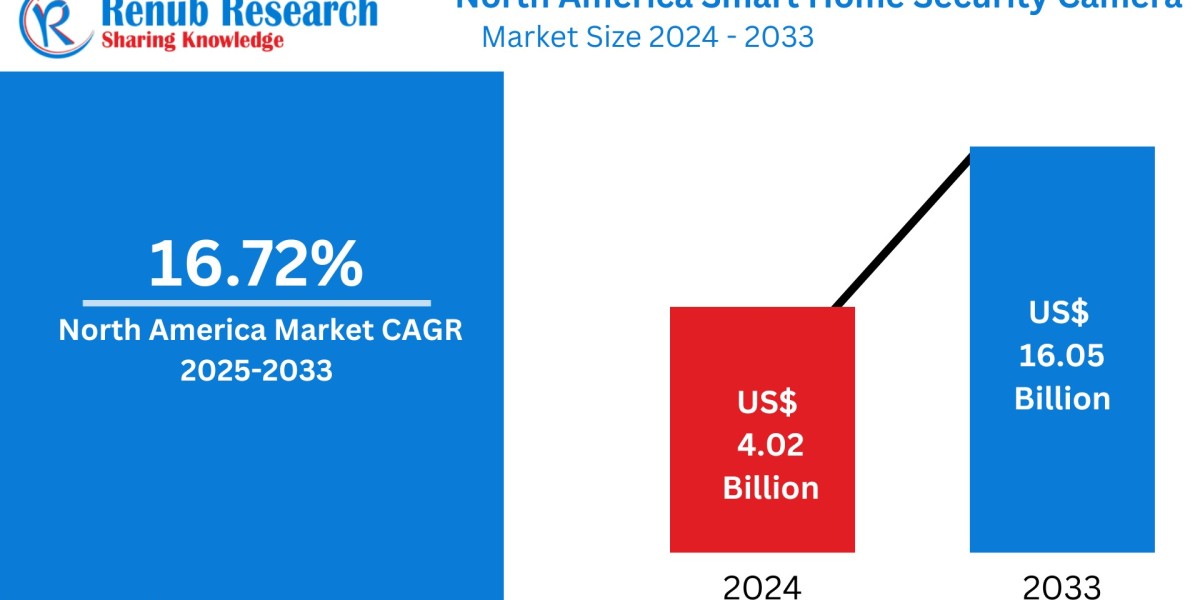

The North America Smart Home Security Camera Market is projected to grow from US$ 4.02 billion in 2024 to US$ 16.05 billion by 2033, expanding at a robust CAGR of 16.72% during the forecast period. Growth is propelled by increasing home security concerns, rapid smart home adoption, AI-driven surveillance innovations, and seamless integration with IoT ecosystems.

Market Segmentation

- By Product:

- Wired Cameras

- Wireless Cameras

- By Application:

- Doorbell Cameras

- Indoor Cameras

- Outdoor Cameras

- By Country:

- United States

- Canada

- Mexico

Market Drivers

- Rising Security Concerns:

With rising crime rates, homeowners are increasingly investing in smart cameras that offer live video streaming, motion detection, and mobile alerts. Over 94 million U.S. households use at least one type of security device. - Advancements in AI & Smart Features:

AI-powered features like facial recognition, automated alerts, and voice assistant integration are driving innovation. Brands like FLIR and Edge360 are pioneering AI-enhanced camera systems. - Smart Home Integration:

Cameras are being integrated with smart locks, lighting systems, and digital assistants like Alexa, Google Assistant, and Apple HomeKit to provide complete security ecosystems.

Related Report

Market Challenges

- Privacy & Data Security Issues:

Concerns over data breaches, unauthorized access, and surveillance misuse continue to limit adoption, especially among privacy-conscious users. - High Initial & Subscription Costs:

Upfront hardware prices and ongoing cloud storage or AI feature subscription fees remain a barrier for budget-sensitive consumers.

Regional Insights

- United States:

The U.S. leads the market, supported by high-tech adoption, DIY security solutions, and robust product innovation. - Canada:

Growth is driven by urbanization, harsh weather (boosting demand for rugged cameras), and an emphasis on privacy-friendly solutions with local storage. - Mexico:

Increasing crime rates, internet penetration, and affordability of smart security solutions are fostering market expansion.

Key Segment Highlights

- Wired Cameras:

Preferred for long-term and consistent power supply needs, especially in gated communities and commercial properties. - Wireless Cameras:

Favored for their flexibility, easy installation, and suitability for renters and DIY users. - Doorbell Cameras:

Rapidly gaining popularity due to online shopping trends and increased package theft. - Indoor Cameras:

Used widely for child, pet, and home monitoring, often integrated into broader smart home systems. - Outdoor Cameras:

High-definition, AI-equipped outdoor cameras with weather resistance are essential for perimeter security.

Key Companies Profiled

- Vivint Smart Home, Inc.

- ADT LLC

- Monitronics International, Inc.

- SimpliSafe, Inc.

- Brinks Home Security

- iSmart Alarm, Inc.

- LiveWatch Security LLC

- Skylinkhome

- Protect America, Inc.

- Samsung Electronics Co., Ltd.

Each company is analyzed on the basis of:

→ Overview

→ Key Personnel

→ Recent Developments

→ Revenue

Report Features

Feature | Description |

Base Year | 2024 |

Historical Data | 2021 – 2024 |

Forecast Period | 2025 – 2033 |

Market Value (2024) | US$ 4.02 Billion |

Market Forecast (2033) | US$ 16.05 Billion |

CAGR (2025–2033) | 16.72% |

Coverage | Product, Application, Country |

Delivery Format | PDF & Excel (PPT/Word on request) |

Customization Scope | Up to 20% Free |

Analyst Support | 1-Year Post-Sale |

Available Customization Options

- Country-level Deep Dive

- Trade & Production Analysis

- Market Entry Strategy

- Competitive Benchmarking

- Custom Company Profiling

- Region-Specific Dynamics