Crude oil is one of the most significant commodities globally, serving as the cornerstone of the energy sector. It is the primary source of fuel for industries, transportation, and power generation, and its price directly impacts global economic stability. As a result, understanding the Crude Oil Price Trend is crucial for stakeholders in various sectors, from energy companies to consumers and investors.

In this article, we will explore the latest trends in crude oil prices, historical data, market analysis, regional insights, and factors that influence price fluctuations. Additionally, we will take a look at the factors that could drive the future price trend of crude oil, providing a comprehensive view of what businesses and individuals can expect in the coming years.

Latest Crude Oil Prices: Market News and Updates

The crude oil market is incredibly dynamic, and prices are subject to a wide range of factors that can cause volatility. Several key developments have recently influenced the price of crude oil, including:

Supply and Demand Dynamics: Global demand for oil is heavily influenced by industrial activity, transportation demand, and economic growth. Any fluctuations in these areas can have a direct impact on crude oil prices. The post-pandemic recovery has seen a surge in demand for energy, pushing prices upward.

Geopolitical Tensions: Crude oil prices are often affected by geopolitical tensions, particularly in major oil-producing regions such as the Middle East, Venezuela, and Russia. Conflicts, sanctions, and disruptions to supply can cause price spikes. Recent tensions involving Russia and OPEC+ production cuts have contributed to price volatility.

OPEC+ Decisions: The Organization of the Petroleum Exporting Countries (OPEC), along with non-member allies like Russia (known as OPEC+), plays a central role in determining crude oil supply. Any decision by OPEC+ to cut or increase production has a direct impact on global crude oil prices.

Energy Transition and Sustainability: The growing push for renewable energy sources and decarbonisation is expected to influence long-term demand for crude oil. However, despite the rise of clean energy alternatives, crude oil remains essential for numerous industries, leading to complex dynamics in future price trends.

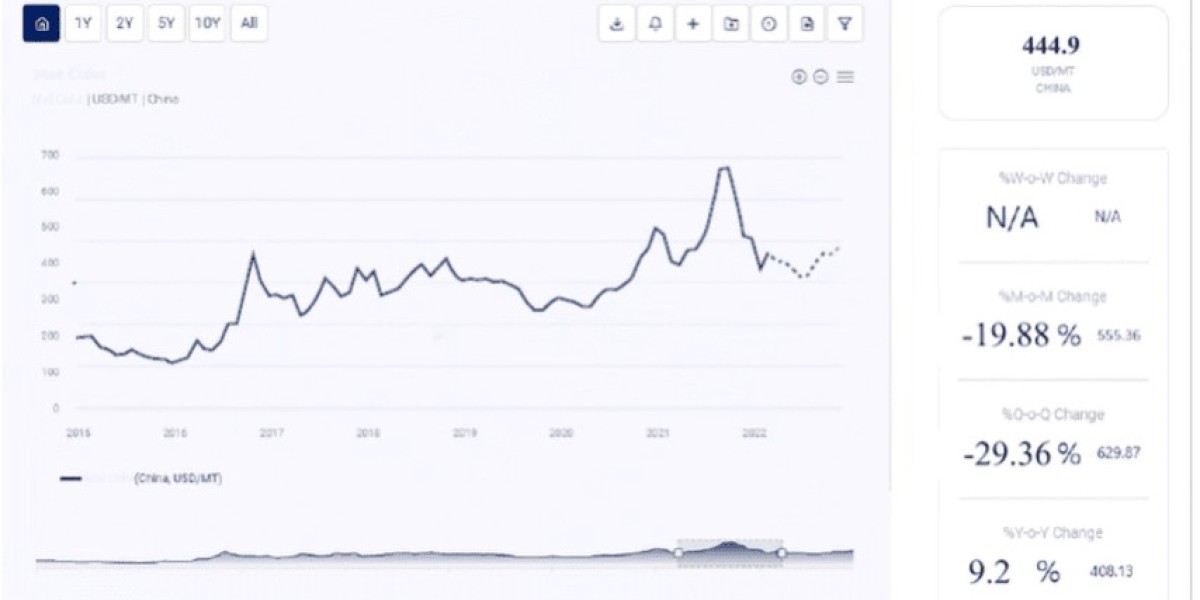

Historical Crude Oil Price Data and Trends

To better understand the Crude Oil Price Trend, let’s look at how prices have evolved over the years. Historical price movements offer valuable insights into long-term market patterns and provide a foundation for future projections.

Historical Price Movements:

Pre-2010: Crude oil prices were relatively volatile, driven by a combination of geopolitical risks and fluctuations in global demand. The price reached historic highs in 2008, with West Texas Intermediate (WTI) hitting nearly $145 per barrel before plunging during the global financial crisis.

2010-2014: The period following the financial crisis saw prices stabilize, hovering between $70 and $110 per barrel. Economic recovery in Asia, particularly China and India, contributed to a steady increase in demand, while the U.S. shale boom started to reshape the global supply landscape.

2014-2016: Crude oil prices experienced a significant crash in 2014 due to oversupply concerns, largely driven by the growth in U.S. shale oil production and OPEC's decision not to cut output. By early 2016, prices had fallen to below $30 per barrel, sparking a global oil market crisis.

2017-2019: After the market correction, prices began to recover, peaking at around $75 per barrel in 2018. This recovery was driven by tightening supply from OPEC+ cuts, improving demand in major markets, and political instability in key oil-producing countries.

2020-2022: The COVID-19 pandemic brought unprecedented volatility to crude oil prices, with demand collapsing and prices briefly turning negative in April 2020 due to the global lockdowns and storage shortages. However, prices rebounded sharply as economies reopened, and OPEC+ production cuts were implemented to stabilize the market.

2023-Present: Crude oil prices saw renewed fluctuations as global economies recovered from the pandemic. The war in Ukraine, coupled with OPEC+ production cuts, pushed prices higher in early 2023. As of 2024, crude oil prices remain influenced by a complex mix of demand, supply disruptions, and geopolitical issues.

Price Forecast and Trends

Forecasting crude oil prices is challenging due to the wide array of influencing factors, from geopolitical developments to technological advancements in energy production. However, certain factors can provide insight into what the market might look like in the coming years.

Demand Recovery: As global economies continue to recover post-pandemic, demand for crude oil is expected to rise. Particularly in emerging markets like China and India, where industrialisation and urbanisation continue to fuel demand for energy, crude oil prices may see upward pressure.

Geopolitical Risks: The global geopolitical landscape will continue to influence crude oil prices. Tensions in the Middle East, Russia, and the broader energy market could create sudden price spikes or dips. Additionally, OPEC+ decisions on production quotas will play a critical role in determining supply.

Energy Transition: The shift toward cleaner, renewable energy sources may gradually reduce the long-term demand for oil. However, the transition will likely take decades, and in the short to medium term, crude oil will remain an essential commodity for industries around the world.

Technological Innovation: Advances in oil extraction technologies, such as fracking and offshore drilling, could increase supply and reduce prices in certain regions. Additionally, new energy technologies, like hydrogen and battery storage, may indirectly influence oil prices as they disrupt energy markets.

Crude Oil Price Charts and Data

Accessing comprehensive and up-to-date price data is essential for companies involved in the oil industry. Price charts provide valuable insights into short-term price movements and trends. Companies can use historical and real-time data to make informed decisions on purchasing, investment, and production strategies.

Key features of crude oil price data include:

- Historical Data: A comprehensive record of past price movements over different time periods, ranging from daily to monthly and yearly data.

- Real-Time Price Charts: Up-to-the-minute updates on crude oil prices, showing real-time fluctuations and market shifts.

- Price Forecasts: Predictions based on current supply and demand trends, geopolitical risks, and other relevant market factors.

Having access to reliable real-time price charts and historical data ensures that businesses can track market trends, forecast price movements, and optimize purchasing strategies.

Regional Insights: How Crude Oil Prices Differ Across Regions

Crude oil prices are not uniform across all regions, and various factors, such as regional supply and demand, transportation costs, and local production, contribute to regional pricing disparities.

North America: The United States is a major oil producer and exporter, with domestic production primarily driven by shale oil. U.S. oil prices often reflect the global market but can diverge due to local supply and demand dynamics. The rise of the U.S. as a key exporter has led to increasing competition with OPEC, affecting global price trends.

Middle East: As the world’s largest oil-producing region, the Middle East plays a critical role in determining global oil prices. Countries like Saudi Arabia, Iraq, and the UAE are key players in OPEC, and their production decisions have a significant impact on global pricing. Geopolitical tensions in this region can also cause sharp fluctuations in crude oil prices.

Europe: Europe’s crude oil prices are influenced by both global supply conditions and the cost of transportation. European nations are heavily reliant on oil imports, which makes them vulnerable to supply chain disruptions and geopolitical risks. Additionally, EU policies promoting energy efficiency and renewable energy may gradually impact demand for crude oil in the long term.

Asia: China and India are the largest consumers of crude oil in Asia, and their growing demand continues to shape global price trends. As industrialisation and urbanisation increase, these nations will continue to exert significant pressure on global oil prices. China, in particular, has been ramping up its oil reserves, further affecting market dynamics.

Request for Real-Time Crude Oil Prices

For companies involved in the energy sector or anyone looking to track crude oil prices, staying updated on real-time price trends is crucial. With fluctuations driven by numerous factors, including geopolitical tensions and shifts in supply-demand dynamics, having access to the latest data can provide a competitive edge.

?Request Real-Time Crude Oil Prices: https://www.procurementresource.com/resource-center/crude-oil-price-trends/pricerequest

Contact Us:

Company Name: Procurement Resource

Contact Person: Leo Frank

Email: sales@procurementresource.com

Toll-Free Numbers:

- USA & Canada: +1 307 363 1045

- UK: +44 7537171117

- Asia-Pacific (APAC): +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA